What’s the Deal with Health Insurance Deductibles? Explained Here!

Health insurance can be a confusing and overwhelming topic, especially when it comes to understanding the different components of a policy. One aspect that often causes confusion is the insurance deductible. This is the amount of money that you are responsible for paying before your health insurance kicks in to cover the rest of your medical expenses. In this blog post, we’ll break down everything you need to know about health insurance deductibles and how they work. So let’s dive in and get a better understanding of this important aspect of health insurance.

Breaking Down the Concept of Health Insurance Deductibles

Health insurance deductibles can be a confusing topic, but breaking down the concept can help you understand how they work and how they can impact your healthcare costs. Essentially, a deductible is the amount of money you are responsible for paying before your health insurance starts to cover the rest of your medical expenses. Think of it as a threshold that you have to reach before your insurance kicks in.

So, let’s break it down further. When you receive medical services, whether it’s a routine check-up or a major surgery, the cost of those services can be quite high. Your health insurance deductible is the amount of money you need to pay out of pocket before your insurance company starts paying their share. For example, if you have a deductible of $1,000, you will need to pay $1,000 towards your medical expenses before your insurance coverage begins.

It’s important to note that not all healthcare services are subject to the deductible. Some preventive services, like vaccinations or certain screenings, may be covered in full by your insurance without requiring you to meet your deductible first. However, most other medical services, such as doctor visits, hospital stays, or surgeries, will require you to meet your deductible before your insurance coverage kicks in.

The amount of your deductible can vary depending on your insurance plan. Some plans have low deductibles, meaning you’ll have to pay a smaller amount before your insurance coverage begins. On the other hand, some plans have high deductibles, which means you’ll have to pay a larger amount out of pocket before your insurance starts to cover your expenses. It’s important to consider your financial situation and healthcare needs when choosing a plan with the right deductible for you.

Now, you may be wondering why insurance companies have deductibles in the first place. Well, it’s a way to share the costs of healthcare between you and your insurance company. By requiring you to pay a portion of your medical expenses upfront, it helps to keep the overall cost of insurance lower. It also encourages individuals to make more informed decisions about their healthcare, as they have a financial stake in the costs.

So, to summarize, a health insurance deductible is the amount of money you need to pay before your insurance coverage kicks in. It’s a way to share the costs of healthcare between you and your insurance company. Understanding your deductible is essential in managing your healthcare costs and choosing the right insurance plan for your needs. Remember, not all services are subject to the deductible, and the amount of your deductible can vary. By being informed and making wise choices, you can navigate the world of health insurance deductibles with confidence.

|

How Do Health Insurance Deductibles Impact Your Healthcare Costs?

Understanding how health insurance deductibles impact your healthcare costs is essential in managing your overall expenses. When you have a health insurance policy with a deductible, it means that you are responsible for paying a certain amount out of pocket before your insurance coverage kicks in.

The impact of a deductible on your healthcare costs can vary depending on the amount of your deductible and the type of medical services you receive. Let’s dive into some scenarios to understand how deductibles work and their potential impact on your expenses.

Scenario 1: You have a $1,000 deductible and need a routine check-up. In this case, you will be responsible for paying the full cost of the check-up out of pocket since routine check-ups are typically not subject to the deductible. So, your deductible does not impact your costs for this service.

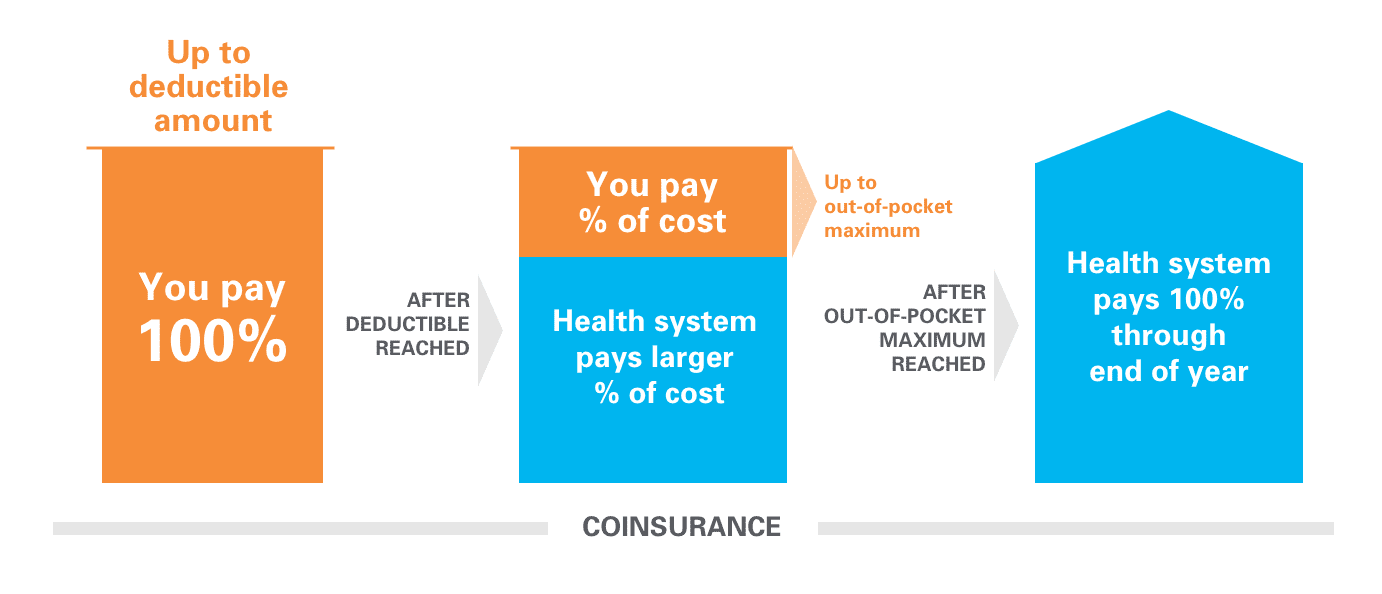

Scenario 2: You have a $1,000 deductible and need to undergo a surgical procedure that costs $5,000. Before your insurance coverage starts, you will have to pay the full $1,000 toward your deductible. Once you meet your deductible, your insurance company will cover a portion of the remaining $4,000, and you will be responsible for the rest, which is called your coinsurance or copayment. The coinsurance or copayment amount is a percentage of the covered claim, and it varies depending on your insurance policy.

Scenario 3: You have a $1,000 deductible and require hospitalization for a serious illness. The total cost of the hospital stay is $20,000. In this case, you will have to pay the full $1,000 toward your deductible. After meeting your deductible, your insurance company will cover a portion of the remaining $19,000, and you will be responsible for your coinsurance or copayment. The coinsurance or copayment amount can still be a significant expense, so it’s important to understand your policy details.

In summary, the impact of health insurance deductibles on your healthcare costs depends on the type of medical services you receive and the amount of your deductible. While some services may not be subject to the deductible, other services, such as surgeries or hospital stays, will require you to pay toward your deductible before your insurance coverage kicks in. Understanding your deductible and the potential out-of-pocket expenses is crucial in managing your healthcare costs effectively.

When choosing a health insurance plan, it’s important to consider your healthcare needs, financial situation, and the amount of deductible that works best for you. A plan with a lower deductible may result in higher monthly premiums but could be beneficial if you anticipate needing more medical services throughout the year. On the other hand, a plan with a higher deductible may have lower monthly premiums but could require you to pay more out of pocket for medical services.

Remember, it’s always a good idea to review your health insurance policy carefully and ask questions if you are unsure about how your deductible will impact your healthcare costs. Being informed and proactive about your healthcare expenses can help you make the best choices for your health and finances.

Understanding When and How You Pay a Health Insurance Deductible

Health insurance deductibles can be confusing, but understanding when and how you pay them is crucial to managing your healthcare expenses effectively. So, let’s dive into the details and break it down.

First, let’s talk about when you pay a health insurance deductible. Typically, you are responsible for paying your deductible at the time of service. This means that when you receive medical care, whether it’s a doctor’s visit or a hospital stay, you will need to pay the agreed-upon deductible amount out of pocket before your insurance coverage kicks in. It’s important to remember that your deductible resets each year, so you may need to meet it again if you require medical services in the future.

Now, let’s discuss how you pay a health insurance deductible. In most cases, you will pay your deductible directly to the healthcare provider or facility at the time of service. This can be in the form of a copayment, which is a fixed amount you pay for each visit or service, or coinsurance, which is a percentage of the total cost of the service. Some insurance plans may also require you to meet your deductible before they start covering certain services, while others may apply the deductible only to specific types of medical care.

It’s important to keep in mind that there are certain exceptions to paying a deductible. For example, some preventive services, like vaccinations or screenings, may be fully covered by your insurance without requiring you to meet your deductible first. Additionally, if you have a plan with a health savings account (HSA), you can use the funds in your account to pay for qualified medical expenses, including your deductible.

To ensure that you are paying your deductible correctly, it’s crucial to review your health insurance policy carefully. Familiarize yourself with the details of your plan, including the amount of your deductible, the types of services that are subject to the deductible, and any exceptions or limitations that may apply. If you have any questions or concerns, don’t hesitate to reach out to your insurance provider for clarification.

Tips on Choosing a Health Insurance Plan Based on the Deductible

Choosing a health insurance plan can be a daunting task, especially when it comes to deciding on the deductible that works best for you. The deductible plays a significant role in determining your out-of-pocket expenses and overall healthcare costs, so it’s essential to consider a few tips when making your decision.

1. Evaluate Your Healthcare Needs: Before selecting a health insurance plan, take the time to assess your healthcare needs. Consider your medical history, any ongoing conditions or treatments, and any potential future healthcare needs. This will help you determine the level of coverage you require and the amount of deductible that makes sense for you.

2. Assess Your Financial Situation: Understanding your financial situation is crucial when choosing a health insurance plan. Take a look at your budget and evaluate how much you can comfortably afford to pay out of pocket before your insurance coverage kicks in. If you have a steady income and can handle higher out-of-pocket expenses, you may opt for a plan with a higher deductible and lower monthly premiums. On the other hand, if you have a limited budget and anticipate needing frequent medical services, a plan with a lower deductible and higher premiums may be a better fit.

3. Consider the Overall Cost: When comparing health insurance plans, it’s important to look beyond just the deductible. Consider the overall cost of the plan, including the monthly premiums, copayments, coinsurance, and any other out-of-pocket expenses you may incur. A plan with a lower deductible may seem appealing, but if it has high monthly premiums and other significant out-of-pocket costs, it may not be the most cost-effective option for you.

4. Review the Plan’s Network: Another factor to consider when choosing a health insurance plan is the network of providers and facilities. Make sure the plan you select includes your preferred doctors, specialists, and hospitals in its network. If you have existing relationships with healthcare providers, it’s important to ensure they are covered by the plan you choose. Going out-of-network can result in higher costs, so carefully review the network details before making a decision.

5. Seek Expert Advice: Don’t be afraid to seek guidance from experts in the field, such as insurance brokers or healthcare advocates. They can help you navigate the complexities of health insurance and provide personalized recommendations based on your unique needs. They can also assist in comparing different plans and helping you understand the potential impact of deductibles on your healthcare costs.

6. Read the Fine Print: Finally, before enrolling in a health insurance plan, take the time to read the fine print. Review the policy documents, including the details of the deductible, copayments, coinsurance, and any exceptions or limitations that may apply. Understanding the terms and conditions of the plan will help you make an informed decision and avoid any surprises when it comes to your healthcare costs.

Choosing a health insurance plan based on the deductible requires careful consideration of your healthcare needs, financial situation, and overall costs. By evaluating these factors and seeking expert advice when needed, you can select a plan that provides the coverage you need while minimizing your out-of-pocket expenses. Remember, choosing the right plan is an investment in your health and financial well-being.

Common Myths and Misunderstandings about Health Insurance Deductibles

Health insurance deductibles can be a complex topic, and it’s no surprise that there are some common myths and misunderstandings surrounding them. Let’s debunk some of these misconceptions and set the record straight.

Myth 1: All healthcare services are subject to the deductible.

This is not true. While many medical services do require you to meet your deductible before insurance coverage kicks in, there are exceptions. Preventive services, like vaccinations and screenings, are often fully covered by insurance without needing to meet your deductible first. It’s important to check your specific policy to understand which services are subject to the deductible and which are not.

Myth 2: Once you meet your deductible, you don’t have to pay anything.

Meeting your deductible means that your insurance coverage will start to kick in, but it doesn’t mean you won’t have any out-of-pocket expenses. After meeting your deductible, you may still be responsible for copayments, coinsurance, or other cost-sharing measures, depending on your insurance policy. These additional expenses can add up, so it’s crucial to review your policy carefully and understand all potential out-of-pocket costs.

Myth 3: Choosing a plan with a higher deductible is always the best option.

While a plan with a higher deductible may have lower monthly premiums, it’s not always the best choice for everyone. Opting for a higher deductible means you’ll have to pay more out of pocket before your insurance coverage begins. If you anticipate needing frequent medical services or have ongoing health conditions, a plan with a lower deductible may be more cost-effective in the long run, despite the higher monthly premiums. It’s important to consider your healthcare needs and financial situation when selecting a plan.

Myth 4: Your deductible must be paid all at once.

This is not necessarily true. While you are responsible for paying your deductible, it doesn’t have to be a lump sum payment. You can often spread out the cost of your deductible over multiple visits or services. For example, if your deductible is $1,000 and you have a doctor’s visit that costs $200, you would only need to pay the $200 at that time, not the full $1,000. However, it’s important to note that you’ll still need to meet your full deductible amount before insurance coverage kicks in.

Myth 5: Your deductible carries over from year to year.

Unfortunately, this is not true. Your deductible resets each year, typically on January 1st. This means that even if you met your deductible in the previous year, you’ll need to start over and meet it again in the new year before your insurance coverage begins. It’s important to keep this in mind when planning for healthcare expenses and budgeting for the upcoming year.

By debunking these common myths and misunderstandings, we hope to provide a clearer understanding of health insurance deductibles. Remember, it’s always important to review your specific insurance policy and ask questions if you’re unsure about any aspects of your coverage. Being informed and proactive about your healthcare costs can help you make the best decisions for your health and finances.