Everything You Need to Know About Universal Life Insurance

Universal life insurance is a popular type of life insurance that offers both a death benefit and a savings component. It’s a flexible and customizable insurance option that allows you to build cash value over time while also providing financial protection for your loved ones in the event of your passing. If you’re considering purchasing life insurance, it’s important to understand what universal life insurance is and how it works. In this blog post, we’ll dive into everything you need to know about universal life insurance, from its benefits and drawbacks to how it differs from other types of life insurance.

Understanding the Basics of Universal Life Insurance

Universal life insurance is a unique type of insurance that combines the benefits of a death benefit and a savings component. It offers flexibility and customization options, making it a popular choice among individuals who want to protect their loved ones financially while also building cash value over time.

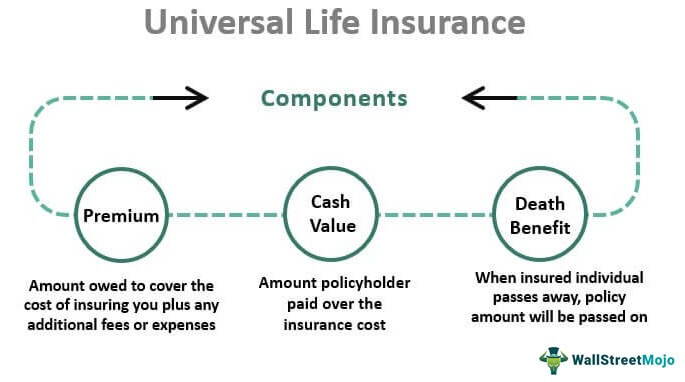

So, how does universal life insurance work? At its core, universal life insurance is designed to provide lifelong coverage. When you purchase a policy, you are required to pay premiums, which are used to fund the death benefit and accumulate cash value. The death benefit is the amount that will be paid to your beneficiaries upon your passing, providing them with financial support during a difficult time.

The savings component of universal life insurance is what sets it apart from other types of life insurance. As you pay your premiums, a portion of the money is set aside and invested, allowing your cash value to grow over time. This cash value can be accessed while you are still alive, offering a source of funds that can be used for various purposes, such as supplementing retirement income or covering unexpected expenses.

One of the key advantages of universal life insurance is its flexibility. Unlike term life insurance, which only provides coverage for a specific period, universal life insurance provides lifelong protection as long as you continue to pay your premiums. Additionally, you have the option to adjust your death benefit and premium payments as your needs change. This flexibility allows you to adapt your policy to suit your changing financial situation.

However, it’s important to consider the disadvantages of universal life insurance as well. One potential drawback is the cost. Universal life insurance tends to be more expensive than term life insurance, primarily due to the savings component and investment element. Additionally, the investment returns on the cash value are not guaranteed, which means there is a level of risk involved.

Advantages and Disadvantages of Universal Life Insurance

Universal life insurance offers several advantages and disadvantages that are important to consider before purchasing a policy. Understanding these pros and cons can help you make an informed decision about whether universal life insurance is the right choice for you.

One of the main advantages of universal life insurance is its flexibility. Unlike term life insurance, which only provides coverage for a specific period, universal life insurance offers lifelong protection as long as you continue to pay your premiums. This means that your loved ones will be financially protected no matter when you pass away. Additionally, universal life insurance allows you to adjust your death benefit and premium payments as your needs change. This flexibility is especially beneficial if you experience significant life events, such as getting married, having children, or purchasing a home, as it allows you to customize your policy to meet your evolving needs.

Another advantage of universal life insurance is the savings component. As you pay your premiums, a portion of the money is set aside and invested, allowing your cash value to grow over time. This cash value can be accessed while you are still alive and can provide a source of funds that can be used for various purposes. For example, you can use the cash value to supplement your retirement income, pay for medical expenses, or cover unexpected costs. This added savings element sets universal life insurance apart from other types of life insurance and can be a valuable asset as you plan for your financial future.

However, along with its advantages, universal life insurance also has some disadvantages. One of the main drawbacks is the cost. Universal life insurance tends to be more expensive than term life insurance because of the savings component and investment element. It’s important to carefully consider your budget and long-term financial goals before committing to a universal life insurance policy.

Another potential disadvantage is the risk associated with the investment returns on the cash value. Unlike traditional savings accounts or certificates of deposit, the investment returns on the cash value of universal life insurance are not guaranteed. This means that the growth of your cash value is subject to market conditions and can fluctuate over time. If the investments underperform, it could affect the growth of your cash value and potentially impact your ability to access funds in the future.

The Different Types of Universal Life Insurance Policies

When it comes to universal life insurance, there are several different types of policies to choose from. Each type offers unique features and benefits, allowing you to tailor your policy to meet your specific needs and goals. Let’s explore the different types of universal life insurance policies and what sets them apart.

1. Guaranteed Universal Life Insurance (GUL): This type of policy offers a guaranteed death benefit for your entire life, as long as you continue to pay your premiums. GUL policies do not accumulate cash value like other types of universal life insurance, but they provide a level of financial security and peace of mind.

2. Indexed Universal Life Insurance (IUL): IUL policies offer the opportunity to earn interest based on the performance of a specific stock market index, such as the S&P 500. This allows your cash value to grow at a potentially higher rate than traditional universal life insurance. However, it’s important to note that IUL policies also come with a cap and a floor, limiting the potential growth and protecting against market downturns.

3. Variable Universal Life Insurance (VUL): VUL policies give you the opportunity to invest your cash value in a variety of investment options, such as stocks, bonds, and mutual funds. This type of policy offers the potential for higher returns but also comes with a higher level of risk. The performance of your investments will directly impact the growth of your cash value.

4. Survivorship Universal Life Insurance: This type of policy covers two individuals, typically spouses, under one policy. The death benefit is paid out when both individuals pass away, providing financial protection for the surviving spouse and any dependents. Survivorship universal life insurance is often used for estate planning purposes, as it can help cover estate taxes and ensure a smooth transfer of wealth.

5. No Lapse Universal Life Insurance: This type of policy is designed to ensure that your coverage remains in force, even if your cash value decreases or becomes depleted. No lapse universal life insurance guarantees that your policy will not lapse as long as you continue to pay your premiums. This type of policy offers a level of protection and stability, especially if you’re concerned about potential fluctuations in your cash value.

Before choosing a specific type of universal life insurance policy, it’s important to carefully consider your financial goals, risk tolerance, and long-term plans. Each type of policy has its own advantages and considerations, so it’s crucial to consult with a financial advisor or insurance professional who can help guide you towards the best option for your individual needs.

Factors to Consider Before Choosing a Universal Life Insurance

Choosing a universal life insurance policy is an important decision that requires careful consideration of various factors. Here are some key factors to keep in mind before making your decision.

First, it’s crucial to evaluate your long-term financial goals. Consider how much coverage you need to provide for your loved ones in the event of your passing. Think about your current financial obligations, such as mortgage payments, debts, and the cost of raising children. Also, think about your future financial needs, such as funding your children’s education or leaving a legacy for your loved ones. Understanding your financial goals will help you determine the appropriate death benefit and premium payments for your universal life insurance policy.

Next, consider your risk tolerance. Universal life insurance policies offer various investment options, such as stocks, bonds, and mutual funds. These investment options come with different levels of risk and potential returns. If you’re comfortable with taking on more risk for potentially higher returns, a variable universal life insurance policy may be suitable for you. On the other hand, if you prefer a more stable and guaranteed growth of your cash value, a guaranteed universal life insurance policy may be a better fit. Assessing your risk tolerance will help you choose the right type of universal life insurance policy for your financial needs.

It’s also important to assess your budget. Universal life insurance tends to be more expensive than term life insurance because of the added savings and investment components. Make sure to review your current financial situation and determine how much you can comfortably allocate towards premiums. Remember that if you fail to make premium payments, your policy may lapse, causing you to lose coverage and any accumulated cash value.

Additionally, consider the company’s financial strength and reputation. You want to ensure that the insurance company you choose has a strong financial foundation and a track record of paying out claims. Research the company’s ratings from independent rating agencies to gain insight into their financial stability.

Lastly, seek guidance from a financial advisor or insurance professional. They can help assess your unique financial situation and guide you towards the best universal life insurance policy for your needs. They can also explain complex terms and conditions, answer any questions you may have, and provide valuable insights based on their expertise.

By considering these factors, you can make an informed decision when choosing a universal life insurance policy. Remember to review your policy periodically and make adjustments as needed to ensure it continues to meet your evolving needs and goals.

Common Misconceptions About Universal Life Insurance

While universal life insurance can be a valuable financial tool, there are several common misconceptions about this type of insurance. Let’s debunk some of these misconceptions and set the record straight.

Misconception #1: Universal life insurance is just like whole life insurance.

Many people confuse universal life insurance with whole life insurance, but they are actually quite different. Whole life insurance offers a guaranteed death benefit and accumulates cash value, but it is more expensive and has less flexibility compared to universal life insurance. Universal life insurance allows for adjustments in premium payments and death benefit amounts, making it a more customizable option.

Misconception #2: Universal life insurance is a great investment.

While universal life insurance does have a savings component that can grow over time, it is important to understand that it is primarily an insurance product. The investment returns on the cash value are not guaranteed, and the growth can be impacted by market conditions. If you are primarily looking for an investment vehicle, it may be more beneficial to consider other options, such as stocks, bonds, or mutual funds.

Misconception #3: Universal life insurance is only for wealthy individuals.

Universal life insurance is often associated with high net worth individuals, but it can be a valuable tool for anyone who wants to provide financial protection for their loved ones. The flexibility of universal life insurance allows you to adjust your premium payments and death benefit amounts to suit your financial situation. It can be particularly beneficial for individuals with changing financial needs, such as those starting a family or planning for retirement.

Misconception #4: Universal life insurance is too expensive.

While it is true that universal life insurance tends to be more expensive than term life insurance, it offers lifelong coverage and a savings component. The cost of universal life insurance varies depending on factors such as your age, health, and the amount of coverage you need. It is important to carefully consider your budget and long-term financial goals before purchasing a policy. Consulting with a financial advisor or insurance professional can help you determine if universal life insurance is the right fit for your budget.

Misconception #5: Universal life insurance is unnecessary if you have other types of insurance.

While having other types of insurance, such as health or disability insurance, is important, they may not provide the same level of financial protection as universal life insurance. Universal life insurance can offer a death benefit that can provide financial support for your loved ones in the event of your passing. Additionally, the savings component of universal life insurance can provide a source of funds that can be used for various purposes, such as supplementing retirement income or covering unexpected expenses.

How to Purchase a Universal Life Insurance Policy

Once you’ve decided that universal life insurance is the right choice for you, the next step is to purchase a policy. Here are some steps to guide you through the process.

1. Assess Your Needs: Before purchasing a universal life insurance policy, take some time to evaluate your financial goals and needs. Consider factors such as your current financial obligations, future expenses, and the amount of coverage you require. This will help you determine the appropriate death benefit and premium payments for your policy.

2. Research Insurance Companies: Look for reputable insurance companies that offer universal life insurance policies. Consider factors such as their financial strength, customer reviews, and claims history. You want to ensure that the company you choose has a strong track record of paying out claims and providing excellent customer service.

3. Consult with a Financial Advisor or Insurance Professional: It’s highly recommended to seek guidance from a financial advisor or insurance professional who specializes in life insurance. They can assess your unique financial situation, explain complex terms and conditions, and help you navigate through the various options available. They can also provide valuable insights based on their expertise and help you choose the best policy for your needs.

4. Get Multiple Quotes: Request quotes from different insurance companies to compare prices and coverage options. Be sure to provide accurate information about your health, lifestyle, and any pre-existing conditions to ensure that the quotes you receive are accurate. Comparing quotes will help you find the most competitive rates and ensure that you’re getting the best value for your money.

5. Review the Policy: Carefully review the terms and conditions of the universal life insurance policy before making a final decision. Pay attention to details such as the death benefit, premium payments, and any additional riders or benefits that may be included. Make sure you fully understand how the policy works and ask questions if anything is unclear.

6. Apply for the Policy: Once you’ve chosen a policy, complete the application process. You’ll be required to provide personal and medical information, as well as consent to a medical examination, if necessary. It’s important to be truthful and accurate when providing information to the insurance company to avoid any issues with your coverage in the future.

7. Underwriting and Approval: The insurance company will review your application and medical records to assess your insurability and determine the premium rates. This process, known as underwriting, can take some time. Once your application is approved, you’ll receive your policy documents and can begin making premium payments.

Remember, purchasing a universal life insurance policy is an important decision that requires careful consideration. Take the time to assess your needs, research insurance companies, and seek professional advice.